Today, the National Association of Home Builders (NAHB) released their Housing Market Index (HMI) showing continued evidence that the new home market is experiencing a prolonged bout of depression.

Today, the National Association of Home Builders (NAHB) released their Housing Market Index (HMI) showing continued evidence that the new home market is experiencing a prolonged bout of depression.The release came along with some congratulatory back patting of the Federal Reserve for their “aggressive actions” as well as a renewed plea for government bailout of the housing debacle from Chief Economist David Seiders who now suggests that without such measures, the economy could fall into recession.

“NAHB applauds the Federal Reserve’s aggressive actions over the weekend in response to escalation of financial market pressures, and we strongly encourage the Fed to ease monetary policy substantially when the Federal Open Market Committee meets tomorrow … With the deepening problems in today’s economy and financial markets, Congress and the Administration should enact additional stimulative measures, and the next round should be directed squarely at the housing sector … A temporary home buyer tax credit, FHA modernization and GSE oversight reform are the three most important things that Congress can accomplish right now to help ensure that housing does not drag the economy into a full-blown recession. Provided that the necessary actions are taken promptly, a housing market recovery most likely would take shape by the second half of this year.”

A representatives from the NAHB made very clear to me that although the individual builder respondent rating (“good”, “fair” and “poor”) data series that are the components of the overall composite HMI series will no longer be published, the methodology has not changed.

When asked why the underlying components would not be published the representative indicated that he was simply instructed to no longer include in the breakouts in the content that gets published to the web.

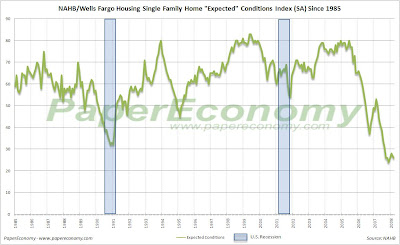

It’s important to understand that each component of the NAHB housing market index is now sitting at or near the worst levels ever seen in the over 20 years the data has been being compiled.

This suggests that the current severe contraction has surpassed all other events seen in the last 22 years and is now firmly in uncharted territory.