The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages, 1 year ARMs as well as application volume for both purchase and refinance applications.

The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages, 1 year ARMs as well as application volume for both purchase and refinance applications.The purchase application index has been highlighted as a particularly important data series as it very broadly captures the demand side of residential real estate for both new and existing home purchases.

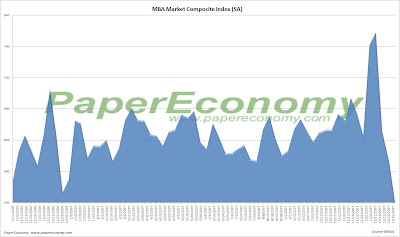

The latest data is showing that the average rate for a 30 year fixed rate mortgage decreased since last week to 6.05% while the purchase volume decreased 8.5% and the refinance volume decreased 15.4% compared to last week’s results.

As I had speculated in the prior MBA posts, today’s results strongly confirm that the “spike up” in volume seen during the first two weeks of December was likely the result of problematic seasonal adjustment and.

As you can see by the charts below (click for larger) the current results show the volume now sitting close to, at or far below the lowest readings in over a year but again since seasonally adjusting a weekly data series is tricky business, look for some of this decline to be erased as we enter a more normalized period sans holiday funkiness.

Also note that the average interest rates for 80% LTV fixed rate mortgages have remained closer to the mean for the year and that the interest rate for an 80% LTV 1 year ARM continues to be elevated with only a 5 basis point spread under the 30 year fixed rate.

It’s important to note that the data is reported (and charted) weekly and that the rate data represents average interest rates, and the index data represents mortgage loan application volume for home purchases, home refinances and a composite of all loans.

The following chart shows how the principle and interest cost and estimated annual income required to cover the PITI (using the 29% “rule of thumb”) on a $400,000 loan has changed since January 2007.

The following chart shows the average interest rate for 30 year and 15 year fixed rate mortgages over the last number of weeks (click for larger version).

The following chart shows the average interest rate for 30 year and 15 year fixed rate mortgages over the last number of weeks (click for larger version).

The following charts show the Purchase Index, Refinance Index and Market Composite Index since January 2007 (click for larger versions).

The following charts show the Purchase Index, Refinance Index and Market Composite Index since January 2007 (click for larger versions).