Today, the National Association of Realtors (NAR) released their Existing Home Sales Report for December again confirming, perfectly clearly, that demand for residential real estate, both single family and condos, has taken a new and substantial leg down uniformly across the nation’s housing markets likely as a direct result of the momentous and ongoing structural changes that are taking place in the credit-mortgage markets.

Today, the National Association of Realtors (NAR) released their Existing Home Sales Report for December again confirming, perfectly clearly, that demand for residential real estate, both single family and condos, has taken a new and substantial leg down uniformly across the nation’s housing markets likely as a direct result of the momentous and ongoing structural changes that are taking place in the credit-mortgage markets.Furthermore, we are now seeing solid declines to the median sales price for both single family homes and condos across virtually every region (save for a paltry increase for condos in the Midwest) with the most notable being declines of 11.2% and 9.7% on a year-over-year basis to the single family home sales price in the West and Northeast respectively.

In the obvious face of home sales not “hovering in a narrow range”, NAR senior economist Lawrence Yun is now calling on Washington to provide a “quick boost” to the nation’s housing market by increasing the non-conforming loan limit (the limit that defines the boundary between Fannie Freddie insured loans and non-agency Jumbo loans).

“Home sales remain weak despite improved affordability conditions in many parts of the country, but we could get a quick boost to the market if loan limits are raised in combination with the bold cut in the Fed funds rate, … Home prices are lower, mortgage interest rates continue to decline and incomes are higher, but many potential buyers are delaying a purchase.”

NAR president Richard Gaylord also chimed in with a shrill and truly offensive take suggesting that it’s “unfair” that some Americans cannot get an $625,000 loan through the federal governments “affordable housing” program.

“The most effective way to stimulate housing and minimize the potential for a recession is for lawmakers to raise the limit on conforming mortgages to $625,000, which would open safe and affordable financing to buyers in high-cost areas, … It is grossly unfair that some Americans do not have access to low-interest rate loans. This would help people as they move away from risky subprime mortgages and high-interest rate jumbo loans.”

The latest report provides, yet again, truly stark and total confirmation that the nation’s housing markets have now taken a new leg down with EVERY region showing significant double digit declines to sales of BOTH single family and condos as well as large increases to inventory and a continued explosion in monthly supply as a result of the collapsing pace of sales.

Keep in mind that these declines are coming “on the back” of last year’s dramatic declines further indicating that the housing markets are truly in the process of a tremendous correction.

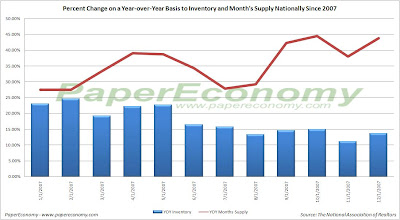

The following (click for larger versions) are charts showing sales for single family homes, plotted monthly, for 2006 and 2007 as well as national existing home inventory and month supply.

Below is a chart consolidating all the year-over-year changes reported by NAR in their December 2007 report.

Below is a chart consolidating all the year-over-year changes reported by NAR in their December 2007 report.